Ellie Cachette, General Partner at Cachette Capital, purports that Europe’s VC ecosystem was never at the bottom, it was just busy building the next ladder.

Europe Shows Up (2007–2010)

In 2007, I distinctly remember sitting in a converted American dinner in San Mateo near Highway 92 which was recently repainted as a sushi place with an American executive and Romanian entrepreneur who were about to poach me from an Indian / British owned software company in Foster City, “We will send you to ROH-MANIA!” proclaimed the Romanian executive who would soon become my boss and lifetime mentor. At 22 years old most of my friends were still wrapping up college, but here I was working full time as a technical software project manager specializing in managing large global tech teams and considering working for a group of individuals mostly coming from a country I had never heard. Up until this point I had never left the U.S and if they had asked me to point Romania out on a map I wouldn’t have gotten the job. A few pieces of sushi later and after considering my current workplace boredom I figured why not, I accepted the job offer and googled “Where is Romania?” Weeks later I was at the company headquarters in Cluj-Napoca, Romania teaching project management to our development managers and coordinating hundreds of deployment schedules to be in sync with our main American clients. To be honest it was one of the most fun jobs I ever had.

Partying underground with co-workers in Cluj-Napoca, Romania circa 2007

Romania was dirty at the time, lots of pollution, confusion over the onboarding of the European Union and the Lei (RON) seemed to fluctuate value on a daily basis. I felt like a dumb cliche American most of the time, not sure how to open doors or understand a word of the language. The cars were tiny and I couldn’t figure out why everyone smoked and ham was seemingly put on every piece of food I could find. I drank lots of beer and shared the secrets of Silicon Valley with hundreds of engineers at the company, including teaching simple things like risk management to software engineers who were extremely talented — the best I had ever worked with at the time — but who did not understand how high the bar was for our American clients. One engineer asked me if a storm took a server down why it was his problem, I had to explain to him the financial repercussions of violating a SLA or Service License Agreement. He didn’t quite get it but he promised me to create a backup plan to honor our friendship. Things were moving along.

Flash forward several years later and I found myself working at a French software development company, specifically working on AI and fraud modeling for financial transactions. The culture was very different from the Romanian development company and was based in SF. The european culture was felt extremely deep within the French company filled with metaphors that made zero sense to me, “Ell-ee, de software iz like a bunny, a bunny that needs to hop, Je pais?” Everyone still wore lots of black and had two hour lunches together — I was starting to get the european vibe down and had managed to even learn how to open european doors and containers. I was making progress both as a professional software manager and as a cultured American. There was hope for tech.

From the French Software company I spent a few years at Macys.com, then running my own startup, then working as an executive for a Colombian development firm. It all seems so random but it wasn’t — I was constantly working with the same amazing developers all over the world it was just which side of the table I was on that changed. Sometimes I was the CEO. Sometimes I was the vendor. Sometimes I was the client. Sometimes I was a VP at the development firm. The global development community is small when you start working with the best but one thing was for sure, not only could I find the best developers in the world but they were always willing to work with me and from this I gained experience working in Israel, Netherlands, Germany, Malaysia, Colombia, Romania, Mexico, Switzerland, the Dominican Republic with extensive periods working in Romania, Germany and Colombia the most.

By the time I was 26 I had rang the Nasdaq bell and been cited as one of the top Women in tech in the U.S. By the time I was 30 I had written two books on software development agreements and had easily $50MM in development projects under my belt, but if you asked my friends what they remember me doing most they would say:

Me getting heckled by Rebecca Woodcock (@recebeccawoodcock) now 500 Startups Entrepreneur-in-Residence, circa 2012 in San Francisco

… Staring at my phone. There’s hundreds of photos like this, where I am simply staring at my phone. I remember even messaging while on a camel in Israel once because a project’s deployment was happening over my Birthright vacation. Certainly not the typical way to spend one’s twenties but I made it work.

Europe Warms Up (2010–2015)

Sometime after my Romanian and French endeavors I remember thinking how valuable I could be to the startup communities if I moved to Europe. I could take this technical project management skillset and apply, as I had in Romania 2007–2009 to create even better engineers and managers. At the time I was mostly looking at Germany but the timing just didn’t seem right — most engineers were still opting for the U.S or to take dev lead jobs in Ukraine or other places which were affordable but gave almost U.S-like salaries. No one at the time was interested in Germany though SAP had just started to put monies in experimenting in accelerators. As a fan of Germany (and Jew) I still felt more comfortable at the time closer to western Germany like Dusseldorf. Berlin was still a bit “off.” Other regions like Latin America were clearly behind Europe in their developmental stages, so after much review and exploring opportunities I moved to New York during this time where I was able to highly contribute to the tech scene there. That tech scene which is fully bustling now and extremely robust, has created a sustainable ecosystem which San Francisco feeds into and off of: its not uncommon on the commuter flights to see techies from SF coming into NY or NY techies heading out west. I don’t regret moving to New York from Silicon Valley during this time instead of Germany, it taught me an important lesson — you cannot speed up the market only pick the right market. Germany and Europe still continued to grow at that time but at the pace that made sense for those communities. Berlin is now a popular spot for mobile growth and a bunch of other hub cities have popped up too like Stockholm, Paris, and London but here’s where things get interesting:

Recently in a Techcrunch article a fund manager was stated as saying

“We haven’t invested internationally. We felt that the ecosystems outside the U.S were substantially weaker, owing to the lack of available follow-on capital”

I couldn’t disagree more — Europe has been a train in the night — building its blocks and talent with influxes of developers coming and going. Similar to when I moved to New York many people were nay-sayers at the time, how could Silicon Valley be replicated outside of Silicon Valley? But the truth is as information spreads and globalization occurs it is no longer about where you live but what you are working on. Just take a look at some hardcore data, not only my emotional instincts:

CCM Report on EU Venture Capital (Report here)

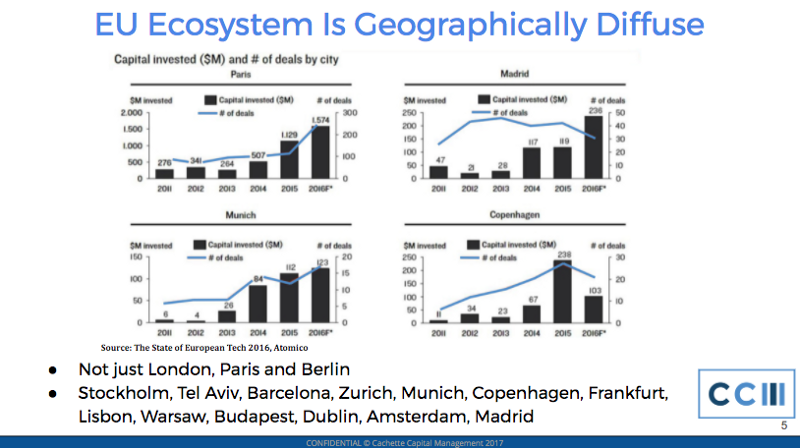

Okay so we know these areas are diverse but what does this mean? Well it means that we are about to have not one unicorn or one hub, but many many unicorns at the same time and they may even be staggered (read: long tail). It means we have literally not one bubble (in a good way) but several in Europe and none of which directly dependent on each other. So what else does that mean? Well it means too there’s a lot to build and a lot of money to be made, if not then how else do you explain this:

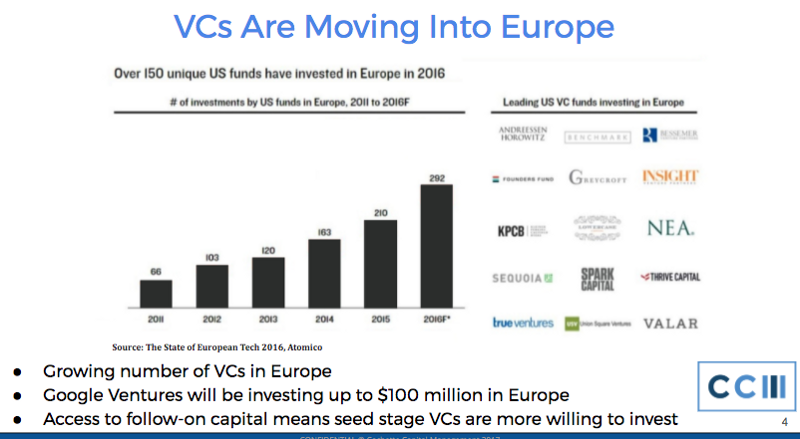

CCM Report on EU Venture Capital (Report here)

If venture capital makes money off of innovation and “selling shovels” then you can see here where the shovel money is going.

European Unicorns (2017–2020)

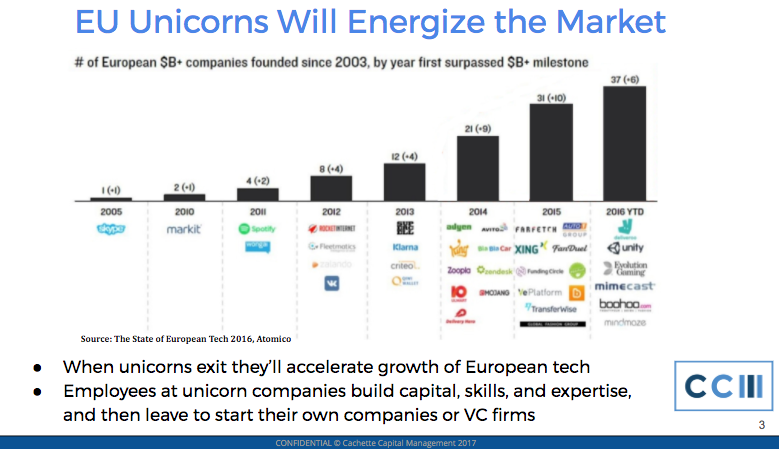

If we follow the logic that Europe isn’t “stable because of the lack of follow-on capital” then that statement too is entirely wrong. Considering the increased inflow of venture capital which is surely going for emerging and early stage building, we have EU Unicorns sharpening their horns at a rate that is unprecedented. As we saw with the “Paypal Mafia” created out of the Paypal exit, these european unicorns are bound to create dozens if not hundreds of millionaires and millionaires in USD who may or may not stay or put this capital back to work in Europe. Just take a look at the all unicorns rising out of Europe:

CCM Report on EU Venture Capital (Report here)

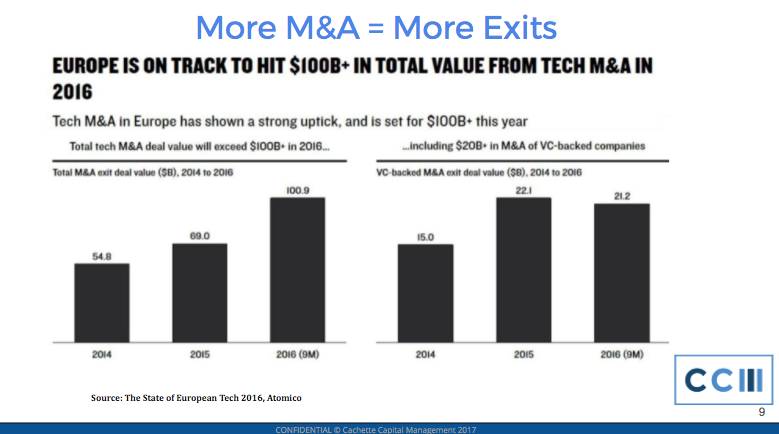

Oh but what if those unicorns aren’t “real” the same way silicon valley companies often implode? Well then let’s look at the MnA data and outlook:

The Magic of Europe

I often get asked in surprise “Oh you’re headed to Europe? What for?” or “I didn’t know you worked or work in Europe” there is this skepticism which I think makes Europe powerful in its underestimation. Most european startups didn’t have the luxury of having bags of capital thrown at them and have always had to be sustainable and think long term about their development and capital spends. Back in the day if a european startup was successful it was rebranded as an American company after tons of funding and never looked back (cough, looking at you Skype) but now we see many (like FarFetch or Travelwise) not even trying to hide their european colors. We have what’s known as a PACK OF UNICORNS and they are speaking multiple languages, spreading across global regions and ready to blossom.

So why does this all matter? Well if you are a european founder you no longer should feel the pressure to leave your native country to start something awesome. Likewise, if you are a venture capitalist you hadn’t worry that Europe isn’t “stable enough” in fact I would argue the opposite, as the founding and General Partner of a global fund-of-funds I’m constantly looking for great venture capitalists who share this vision and aren’t afraid to invest in things which hold the key to the future.

As Drake would say, “I started from the bottom now I’m here” but the truth is Europe was never at the bottom it was just busy building the next ladder.

This piece was originally posted on Medium.