“I have always been attracted to computationally hard problems,” Gemma Garriga says. She took the helm of Allianz’s global artificial intelligence (AI) team less than a year ago, after five years with the company.

Before that, she enjoyed a decade-long research career that culminated in a senior tenured leadership position at INRIA, the French National Institute for Computer Science and Applied Mathematics, and the birthplace of several transformative computer science projects, such as Caml, a programming language whose OCaml implementation is used in Jane Street, Facebook, and Bloomberg, to name a few.

“I’m interested in many technical problems,” she says, “spanning from learning from sequential event data and time series, with applications in telecommunication networks and security, to the analysis of large amounts of graph data.” Her interests are reflected in her extensive research opus encompassing more than a dozen publications and an award from the PASCAL (Pattern Analysis, Statistical Modelling and Computational Learning) Network of Excellence.

And, fittingly, her wide-ranging interests and skills all have immediate application to her current job.

[su_pullquote align=”right”]“I have not come across anyone with a similar combination of diverse, deep technical skills and extraordinary leadership abilities.“[/su_pullquote]

Allianz is a financial behemoth with over 80 million insurance customers and nearly €2 trillion under management. Garriga leads their interdisciplinary team of 30 people, comprising top machine learning and engineering talent.

“It feels like I’m leading a startup,” she says. Her team’s job can be divided into two broad areas: on the one hand, infusing machine learning into workflows to supercharge its business lines and make internal processes more automated and efficient, and on the other hand, disseminating the AI understanding throughout the company by creating educational content and sharing best practices.

Garriga and her team have created a data science training program for Allianz employees, which covers everything from the theoretical foundations of machine learning to the development and deployment of solutions. The company sees it as essential that employees have a basic understanding of the concepts.

“Our digital transformation, enabled by data and technology, is not a standalone, self-contained project.” Garriga points out. “An understanding of these elements, as well as how AI can contribute to the efficiency and growth of the business—and improve the customer experience—is the responsibility of every employee.”

[su_pullquote align=”right”]“Leading a team is like building a puzzle: You need to know and understand the pieces and the objective well, in order to put them together.”[/su_pullquote]

They organize regular internal events and conferences, in collaboration with other departments, on the topic of data and advanced analytics. Most recently, they launched an internal open source data science library, where data scientists from all around the company are able to share their machine learning business templates, general functions, and practices for solving insurance challenges with AI.

Allianz Group’s COO, Christof Mascher, says, “I have not come across anyone with a similar combination of diverse, deep technical skills and extraordinary leadership abilities. We would love to have more talent like Gemma at the Allianz Group.”

On the essential elements of effective leadership, Garriga says, “It’s important to be genuinely passionate about what you’re doing, in order to engage a team. I like to rally for a big vision and to empower people to make the most of their strengths and their unique differences to achieve that vision. Leading a team is like building a puzzle: You need to know and understand the pieces and the objective well, in order to put them together; and, you need to be willing and flexible enough to find the best solutions to achieve the overall goal.”

AI-enabled insurance products

“One area where AI is particularly useful,” Garriga says, “is within underwriting, the evaluation and the assessment of risk. How do you understand the needs of your customer and the risk you’re undertaking by offering a certain insurance product while keeping the best customer experience and not asking a long list of tedious questions? Machine learning models use the contextual data at the time of the quotation and onboarding of a customer to do risk assessment in real time.”

But, traditional insurance products don’t always work for the new business models, Gemma points out, such as businesses and services created with the rise of the sharing economy.

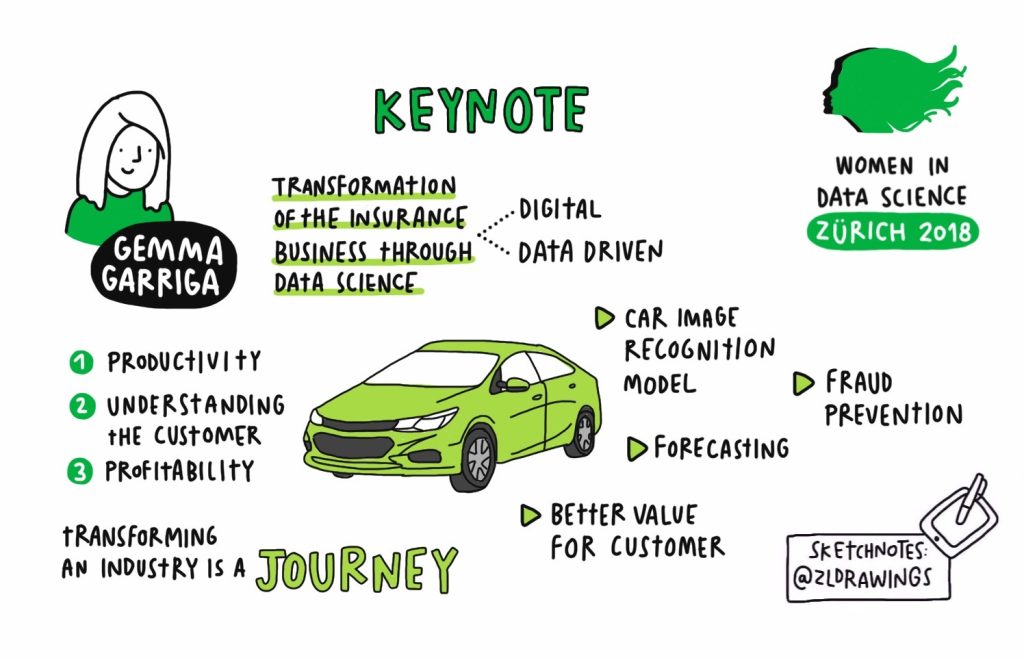

Summary of Garriga’s keynote talk entitled “Insurance Business Transformation through Data Science” at the Women in Data Science conference held on the 20th March at the Swiss Re’s Centre for Global Dialogue, Zurich, Switzerland. Illustrations by: Zsofi Lang.

“Let’s take the example of car sharing. The traditional car insurance product is a longer term—usually one-year—product with risk estimated for the usage throughout the whole year, even if you only use the car for a few days or a couple of trips. New, AI-supported insurance offers services adapted to the on-demand customer needs. These are digital products, simpler to understand, time-framed or cancellable, and coupled with a variety of additional services, not only for cover in case of an accident, but also to improve the usage experience and add value.”

The most impressive undertaking in this area so far was designed by Lemonade, an insurtech company offering insurance to renters and homeowners, which in just three years, garnered the accolades of both its customers and the venture capital sector, raising $180 million from Allianz, Softbank, Sequoia, GV, and General Catalyst, among others. Their API-first approach simplified the insurance offering to the record-breaking point of the fastest paid claim—just 3 seconds.

“APIs are technical communication layers that connect the offer with the demand. They make insurance more available and get our services closer to the customer. This operating model is simpler, more efficient, and productive—all of which is to the advantage of our customers,” explains Garriga.

Lemonade isn’t the only API-based success story Allianz is involved in. Stripe, beloved by the startup world and increasingly used by large enterprises and government entities, recently announced Allianz as one of their customers.

[su_pullquote]Her team performs a significant amount of in-house research. They study, among other things, the usage of cloud services and develop their own machine learning algorithms for fraud detection and underwriting.[/su_pullquote]

Despite many notable achievements, AI implementations don’t come without their own set of challenges. “We operate in over 70 different countries,” Garriga says, “and every market is different. The challenge is to create solutions that every business line and customer in every market can benefit from.”

To satisfy these demands, her team performs a significant amount of in-house research. They study, among other things, the usage of cloud services and develop their own machine learning algorithms for fraud detection and underwriting, as well as new AI methods to make the claims processes automated and customer-friendly.

Garriga has been emphasizing ethics and data privacy. “When we combine a focus on the customer with technology and security, then human and machine work together to address the challenges of managing risk,” she says.

“I look forward to the transition,” she says, “to a new business model for insurance, where machine learning is fully integrated and powers a new experience of products and services. This will require the right technology-enablement in the company and also a creative understanding of the insurance business through the lens of AI.”