Over the holidays, there was a bit of a firestorm on Twitter over comments made by venture capitalist Joe Lonsdale of 8VC regarding VCs and racism. The original tweets and resulting dialog inspired me to write this post in an attempt to address the question that was posed: how do we explain the fact that only 1% of VC capital goes to Black founders? “Are VCs racist?” Or perhaps a better-framed question, “Why is there such a persistent race gap in the VC industry?” As we look ahead to 2022, I believe this issue is one of the most important ones that our industry needs to grapple with.

For context, I have been examining the systemic biases in the tech industry for a number of years as a result of three hats that I wear. First, through my day job as a practicing venture capitalist – I cofounded a NY and Boston-based early-stage VC fund, Flybridge Capital roughly 20 years ago. Second, through my civic work at Hack.Diversity – a workforce development nonprofit I co-founded six years ago that provides a pathway for young Black and Latinx professionals into the tech ecosystem. And finally, through my part-time work as a member of the faculty at Harvard Business School where I recently created a course with my colleagues Professors Henry McGee and Archie Jones called Scaling Minority Businesses, a field course where we study the impact that systemic racism, lack of access to capital, and lack of access to customers has on minority-owned businesses.

I am not a scholar in the field of systemic racism and bias. Instead, I am an intellectually curious practitioner and a white male of privilege trying to learn about these issues and through that learning, apply them to change a pernicious injustice in our startup ecosystem. It’s a journey and I know I have more work to do, as do the institutions that I’m a part of.

Beyond correcting these injustices, I have also been studying this area in an attempt to be a better investor. Over the years as I’ve read and discussed these issues, my thinking has changed. Once you lift the veil on all of the unconscious biases and racist systems that require dismantling, it’s hard to see the world the same way. But I am also seeing some amazing progress and emerging leaders who are successfully challenging the status quo and changing this system one brick at a time.

Joe Lonsdale’s Tweets

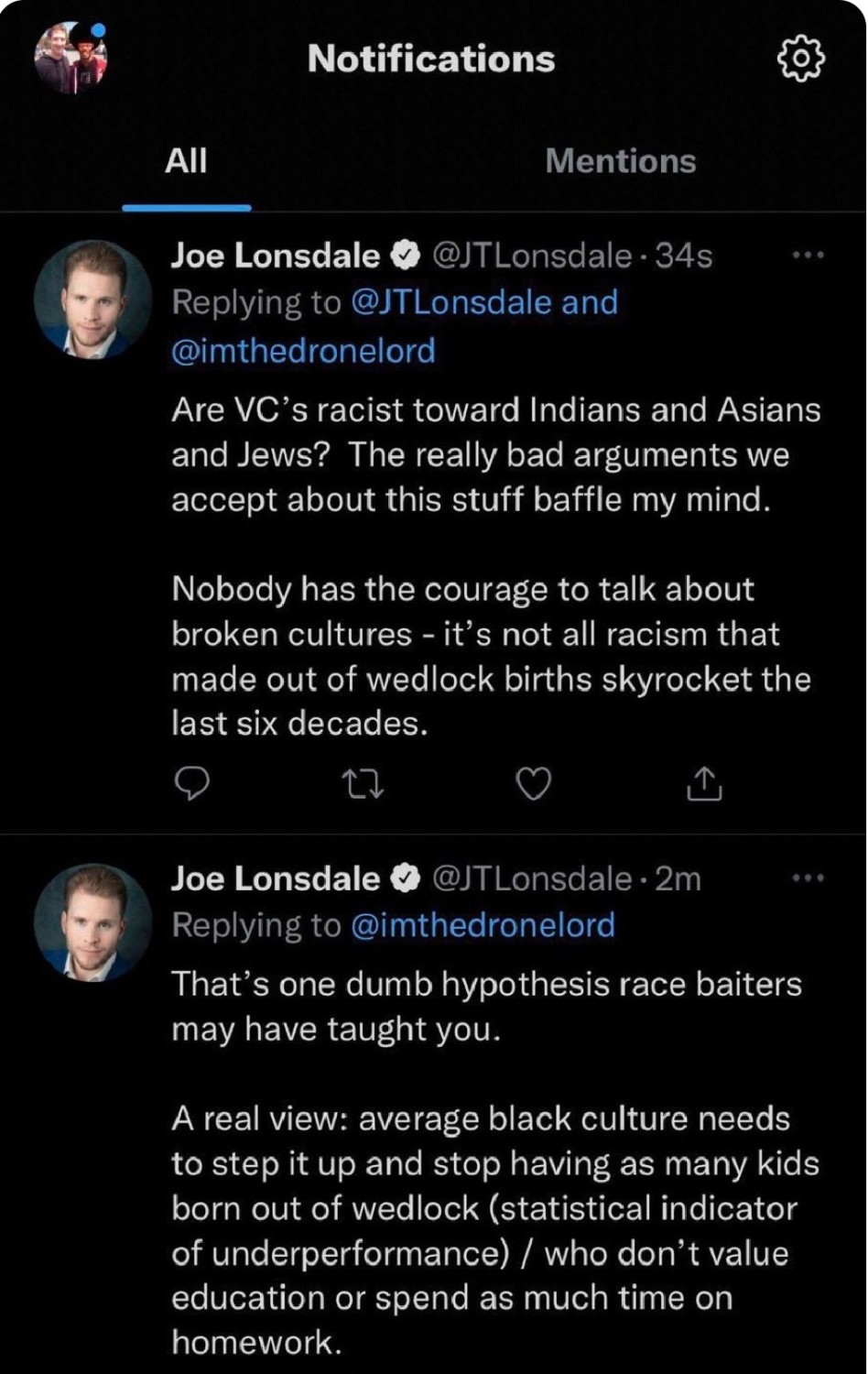

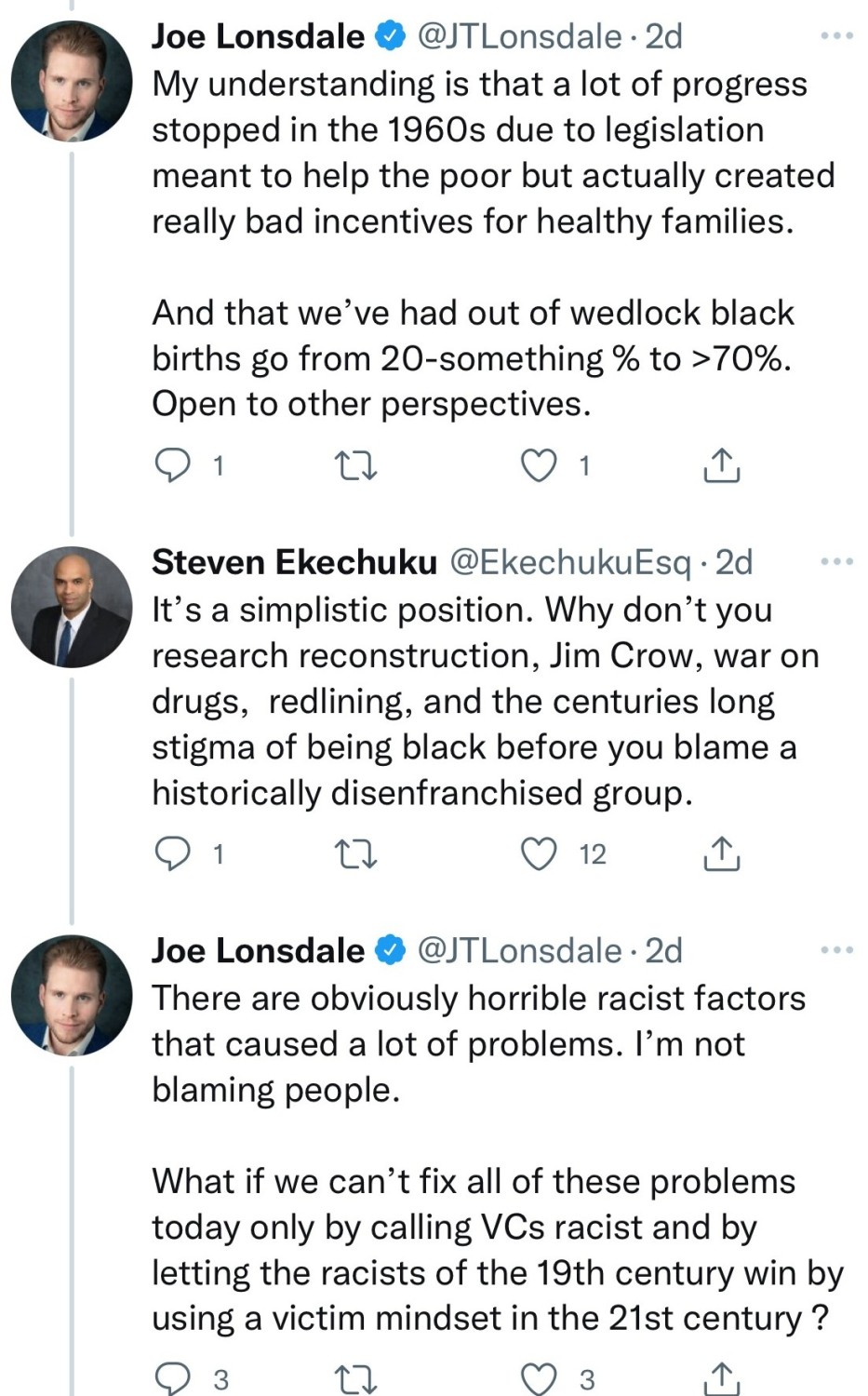

So with that background, let’s dive in. First, let me share the tweets that Lonsdale posted. The first one was in response to a tweet from a venture capitalist and entrepreneur named Prince Ramses (@imthedronelord):

Lonsdale later deleted that tweet but followed it up with another two that I’ll include here in response to a thoughtful reply from Steve Ekechuku, a NY-based lawyer:

There were a number of other tweets in the subsequent back and forth, but I’ll stop here for now as I think these three capture the essence of the comments that sparked the controversy.

I should state upfront that I don’t know Lonsdale. Although we are in the same small industry, we have never met. Reading his tweets really upset me. And I can’t even imagine how upsetting they were for Black VCs and entrepreneurs. That said, I want to try to turn the incident into a “teachable moment” and broaden the conversation to examine the three biggest contributors to the race gap in VC funding.

1. Systemic Biases (Largely Unconscious) and Discrimination

Each year, Flybridge chooses a non-business book to send to our founders as a year-end gift. This year, we chose an influential book in social psychology called Blindspots: Hidden Biases of Good People. The authors, Professors Anthony Greenwald of the University of Washington and Mahzarin Banaji of Harvard, build on their pioneering work in creating the Implicit Association Test (IAT) to demonstrate that human beings have strong, often unconscious and instinctive, biases. In research study after study, the authors describe these remarkable “mind bugs” that show how our unconscious preferences manifest themselves in strange, surprising and sometimes disturbing ways.

The implications of this social psychology insight are powerful in the context of racial discrimination. Although the authors indicate that various studies show that we have seen explicit, overt biases decrease in America in recent decades (I should note that the book was published in 2013 – years prior to the Trump era and the recent rise in hate crimes), strong implicit biases remain. Specifically, the IAT has “revealed that approximately 75% of Americans display implicit (automatic) preference for white relative to Black.”

Towards the end of the book, the authors conclude that these hidden biases “plausibly contribute more to discrimination in America than does the overt prejudice of an ever-decreasing minority of Americans.” In their appendix, they frame that “Black Americans experience disadvantages—meaning inferior outcomes—on almost every economically significant dimension. This includes earnings, education, housing, employment, status in the criminal justice system, and health.” And they acknowledge that there are two theories of Black disadvantage. Again, quoting from the appendix: “One set of theories credits Black Americans themselves with full responsibility for the disadvantages they experience. The other set…place the entire responsibility elsewhere.” The authors conclude that “institutional discrimination as a cause of Black disadvantage is undeniable historical fact.”

I believe this book contains important implications for our startup ecosystem. The authors’ insight that “human judgment and behavior is produced with little conscious thought” is illuminating in the context of investment and hiring decisions. In Startupland, these decisions are made with a modest amount of data and in the context of a large number of complex variables. Thus, instinct is a powerful force in decision making and instinct is rife with biases, both conscious and unconscious. Pattern recognition can be used as a weapon in startup pitches by founders. I once had a young entrepreneur kick off our pitch meeting by sharing that he was a Harvard dropout. I later found out that he actually never attended Harvard College and never dropped out. Instead, he enrolled in a few Harvard extension school courses, which are open to the public, and then ceased enrolling in the extension school. Obviously, he was trying to anchor me and my unconscious mind on famous Harvard dropouts like Bill Gates and Mark Zuckerberg, using the power of association to create a favorable impression of his founder journey. This example is somewhat harmless (I didn’t fall for it), but it’s emblematic of how unconscious, positive associations towards some founders and negative towards others can affect investment decision-making and lead to less capital going towards Black founders.

Another terrific book by NYU Professor Jonathan Haidt demonstrates that these biases are inherent in humans, very natural, and very hard to deconstruct. The Righteous Mind is a book that Haidt, another social psychologist, wrote to explain tribalism in politics but I read it through the lens of a venture capitalist and what it said about our ecosystem. Like Greenwald and Banaji, Haidt reviews the extensive research and philosophical underpinnings that show that humans are fundamentally intuitive decision-makers. His work is more focused on moral judgments and the insight that moral judgments are unconscious and that these unconscious cognitive processes are evolutionary in nature, allowing us to form social groups and tribes. This rapid intuitive judgment is a powerful force that is then followed by rationalization. As Haidt points out, “the intuition launched the reasoning, but the intuition did not depend on the reasoning.”

If these two books are right, we should see evidence of these unconscious biases in investor decisions. Not surprisingly, a few recent studies have shown exactly that.

2. Intuitive, Biased Investment Decisions: Gender and Race

In 2017, four researchers (including my colleague Professor Laura Huang) published a ground-breaking article in Harvard Business Review that observed Q&A interactions between 140 prominent VCs and 189 entrepreneurs that took place at TechCrunch Disrupt New York. When they analyzed the Q&A sessions, they saw that VCs asked different types of questions to the male founders than they did to the female founders. VCs “tended to ask men questions about the potential for gains and women about the potential for losses.” Surprisingly, the researchers found evidence of this bias with both male and female VCs! Not surprisingly, entrepreneurs that are asked promotion-based questions raise more money than those asked prevention questions. In other words, male and female VCs had similar intuitive biases about the male and female entrepreneurs they met with, resulting in more capital going to male entrepreneurs.

In 2019, Stanford Professor Jennifer Eberhardt and colleagues published another study demonstrating the unconscious biases of asset allocators. By creating fictitious VC fund manager profiles and asking prospective limited partners (LPs) to evaluate those profiles, the researchers showed that LPs were unable to properly assess Black-led VC managers or distinguish between the stronger and weaker, Black-led teams. Professor Eberhardt concludes, “One explanation of this finding could be that investors rarely see Black-led teams. They simply don’t know how to evaluate them.” (I should note that Professor Eberhardt also recently wrote a book on hidden biases: “Biased: Uncovering the Hidden Prejudices That Shapes What We See, Think, and Do”. I haven’t read it yet, but it’s on the list!).

These studies are manifestations of substantive racial biases in our ecosystem – perhaps some of these lead to overt racism but, in my opinion, and based on the research, even good people who are not racist also demonstrate unconscious and instinctual biases.

Black VCs and entrepreneurs don’t need academic studies to tell them what they experience day to day. Venture capitalist and entrepreneur James Norman wrote a compelling HBR article called, A VC’s Guide to Investing in Black Founders in which he discusses differences between Black and white founders. These differences can lead to different profiles, paths, cultures, and styles of communication. As Norman points out, “Unfortunately, you can count on one hand the number of investors who have first-hand experience with our journey, and there are only a handful more investors that look like us.” (disclosure: Norman launched a new VC fund called Black Ops VC where I’m a personal investor).

3. Historical, Systemic Racism and the Wealth Gap

Continuing Norman’s theme, we now turn to the second powerful force that leads to the “1% problem” – historical, systemic racism and the wealth gap. When researchers and historians examine the economic implications of systemic racial biases as manifested in policies, the scorecard is pretty damning. Brookings scholar Andre Perry wrote a powerful book reviewing this history called Know Your Price: Valuing Black Lives and Property in America’s Black Cities. In the book, Perry builds on previous work by some of his Brookings colleagues in measuring the Black-white wealth gap – where the average Black household has $17,600 in median net financial worth as compared to $171,000 for the average white household – and outlines the underlying factors that have led to this disparity. Perry reviews policy decisions around redlining and housing, urban development, disparities in schools, health care, and incarceration policies to demonstrate the uneven playing field that Black households have faced in recent decades.

For more on housing policy in particular, I also highly recommend Berkeley Professor Richard Rothstein’s seminal book on redlining and housing – a critical source of household wealth for Black and white households in recent decades – called Color of Law: A Forgotten History of How Our Government Segregated America. These two books as well as many others (e.g., Keeanga-Yamahtta Taylor’s How Banks and the Real Estate Industry Undermined Black Ownership) provide a glaring picture of policies that have consistently held back economic development for Black businesses and families, thereby reducing the opportunity for generational wealth creation. Linking the impact of these policies on the 1% problem is clear, for example:

- Black families have dramatically less wealth so young Black professionals from those families take on less risk early in their career when they are still establishing themselves and paying down their loans.

- Friends and family money to support very early company formation is more plentiful in white families than Black families.

- Professional networks with access to early-stage capital are more available to white professional networks than Black professional networks.

- Black professionals don’t have easily accessible friends and family ties to the industry because the industry is small and closed.

With so few allocators of capital being Black (one analysis by my colleague Professor Josh Lerner showed that only 1.3% of assets under management are controlled by substantially and majority diverse-owned firms, which include women and minorities), with the important role of pattern recognition and intuition in decision making, and with the historical systemic policies and practices that have led to dramatically lower levels of wealth in the Black community, it is no surprise that we are where we are with only 1% of funding going to Black entrepreneurs.

The arguments above suggest that it is not because VCs or even LPs are overtly racist (although I acknowledge that some are and many Black founders and VCs have shared some pretty bad stories of encounters with them). Like many other humans, they’re highly biased decision-makers operating in the context of a historically racist system. Unlike many other humans, those biased decisions have massive economic consequences.

What Are The Solutions?

Hedge fund manager Howard Marks famously observed that the best investments come from nailing a theme or bet that is non-consensus. That’s why Flybridge has intentionally pursued a series of strategies in recent years to increase our investment in more female founders (see XFactor Ventures) and founders of color (see The Community Fund, where we are seeking to add a few new partners): we believe we are going to find amazing investment opportunities that others are missing. And it’s why I’ve been personally investing in more Black VC managers, such as Black Ops VC, Visible Hands, Collab Capital, Stellation Capital, and others – these managers and others like them are seeing attractive investment opportunities that I am not seeing and don’t have access to. There is much more we can and will do in the coming years. And I hope that other VCs and LPs follow the opportunity and direct more institutional and personal capital to underrepresented VC managers.

Fortunately, there are promising efforts underway to get more capital in the hands of emerging Black managers as well as Black founders – initiatives that, critically, are breaking open the small coterie of insiders that control the industry. Many are being driven by LPs (who are allocating capital to Black founders and asking hard questions of non-diverse managers), by entrepreneurial VCs (who are creating both new funds and changing the culture and processes of big firms from within), and by founders. Successful founders have tremendous power in this industry. I hope to see more founders creating wildly successful companies led by diverse teams. But I also hope to see all founders demand that their cap tables and board rooms contain diverse leaders.

These efforts and the rise of strong, talented emerging Black managers (e.g., Precursor Ventures, MaC Venture Capital, Harlem Capital, Backstage Capital, RareBreed VC, and many more as well as the ones mentioned above) give me hope that we are seeing a sea change in our industry. It will take years to play out – largely because of the unconscious biases, historical racism, and friction points mentioned above – but I’m hopeful that we won’t be talking about the 1% problem in ten years. And I sure hope that we won’t see other powerful and prominent VCs making hurtful proclamations that inappropriately attack or blame Black people and culture for the funding gap. The story of the coming years is more likely to be the rise of many wildly successful entrepreneurs and investors from backgrounds, cultures, and countries that we have not seen before.

We all have a role to play in helping facilitate that outcome. My hope is that in so doing, we will finally achieve the dream of leveraging the power of all the talented humans on this planet eager and ready to innovate.

This piece originally appeared on LinkedIn, and was published here with permission.