This, and other insights as the seed-stage venture firm looks back on the past 10 years.

By First Round Capital

This post originally appeared on First Round Capital.

Ten years is a long time. When we started First Round in 2005 with the idea to fill the gap between individual angel investing and Series A investing, many on Sand Hill Road dismissed our model as a “cute” novelty. Boy how times have changed. What began as a crazy, contrarian idea has now led to a Series Seed Surge — in the last 4 years alone, over $4 billion has flowed into seed stage and 200 new firms have been formed.

Venture capitalists are constantly telling the entrepreneurs they invest in to make data-driven decisions. But as an industry, we haven’t been very good at doing it ourselves. Now that we have the analytics and numbers to take a closer look at ourselves and our business, we decided to give it a try. We were able to sit down with 10 years worth of our proprietary investing data in front of us — since we’ve been capturing data about founding teams in our community since we made our very first investment in January 2005.

We believe that seed investing is much more an art than a science — and there’s no such thing as a formula for success — but analyzing this unique data set of 300 companies and nearly 600 founders turned out to be a fascinating exercise. We looked at the founder characteristics that accompanied successes and not quite successes. Of course there were counterexamples and outliers (we actually removed the biggest outlier of all, Uber, from the study), but some definite themes emerged.

After diving into the data and testing various assumptions, we’ve surfaced “10 Lessons” that we want to share with the whole industry.

To be clear, we recognize that our data is still a small subset of the overall market — and (we hope) we’re better venture capitalists than statisticians — but the analysis provides an interesting and unprecedented window into the question: “What does a great seed investment look like?”

To simplify things, we evaluated every company’s performance by looking at how much their value has grown (or shrunk) between our initial investment and their fair market value today (or at exit). See below for more details on our methodology — we recognize it’s far from perfect, but it’s the clearest.

And looking through this lens, some interesting themes emerged…

1. Female Founders Outperform Their Male Peers

We’ve been fortunate to back many companies with female founders (and women-founded companies represent a greater percentage of our investments than the national VC average). That’s why were so excited to learn that our investments in companies with at least one female founder were meaningfully outperforming our investments in all-male teams. Indeed, companies with a female founder performed 63 percent better than our investments with all-male founding teams. And, if you look at First Round’s top 10 investments of all time based on value created for investors, three of those teams have at least one female founder — far outpacing the percentage of female tech founders in general.

2. Startup Fortune Favors the Young

Founding teams with an average age under 25 (when we invested) perform nearly 30 percent above average. And while the average age of all our founders is 34.5, for our top 10 investments the average age was 31.9.

3. Where You Went to School Matters

We also looked at whether the college a founder attended might impact company performance. Unsurprisingly, teams with at least one founder who went to a “top school” (unscientifically defined in our study as one of the Ivies plus Stanford, MIT and Caltech) tend to perform the best. Looking at our community, 38 percent of the companies we’ve invested in had one founder that went to one of those schools. And, generally speaking, those companies performed about 220 percent better than other teams!

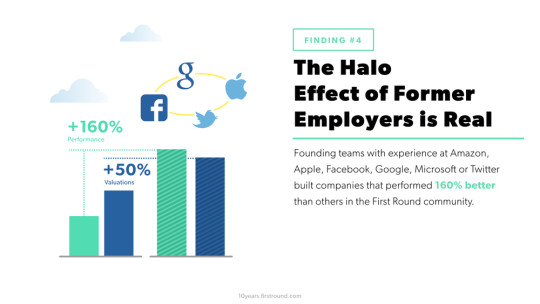

4. The Halo Effect of Former Employers is Real

Teams with at least one founder coming out of Amazon, Apple, Facebook, Google, Microsoft or Twitter, performed 160 percent better than other companies. And while school didn’t have any real impact on pre-money valuations, company alma maters did. Founding teams with experience at any of those marquee companies landed pre-money valuations nearly 50 percent larger than their peers. We have some theories about causation here: the impact of embedded networks, foundational skills these types of jobs provide. These factors clearly make a difference.

5. Investors Pay More for Repeat Founders

While entrepreneurial experience is obviously valuable at the seed stage, we were surprised to see that our investments in repeat founders didn’t perform significantly better than our investments in first-timers — mainly because successful repeat founders’ initial valuations tended to be over 50% higher. It’s interesting to see how the market effectively prices repeat founders higher because they are known quantities.

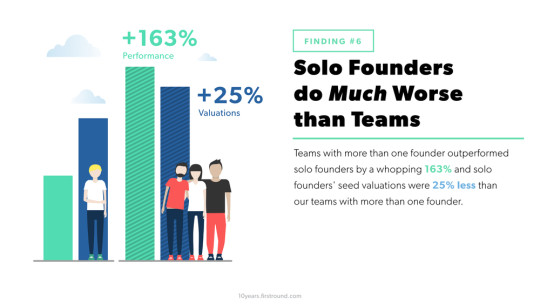

6. Solo Founders do Much Worse Than Teams

Taking a closer look at these founding teams, we wanted to know what size and shape did to performance. The results were stark: Teams with more than one founder outperformed solo founders by a whopping 163 percent and solo founders’ seed valuations were 25 percent less than teams with more than one founder. No wonder the average size of founding teams across the FRC community is two, which also happens to be the optimal number according to our data.

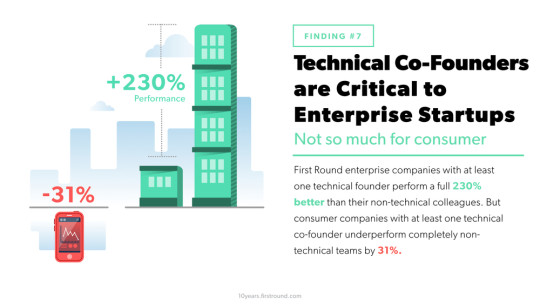

7. Technical Co-Founders are Critical to Enterprise, Not so Much for Consumer

With all the industry chatter about the importance of technical co-founders, we wondered just how critical they are to success. It turns out, pretty critical — for enterprise companies. In fact, they’re doing so well in enterprise — performing a full 230 percent better than their non-technical colleagues — that they skew the data set to make it look like teams with a technical co-founder perform 23 percent better overall. But this isn’t the whole story. In fact, consumer companies with at least one technical co-founder underperform completely non-technical teams by 31 percent.

8. You Can Win Outside the Big Tech Hubs

We thought location might make an equally dramatic difference, but we were wrong. First Round companies founded outside New York and the Bay Area are performing just as well as their peers based in those epicenters. Of the 200 companies we looked at for this, 25% landed outside these cities and, on average, have performed a slim 1.3 percent better than companies in the Bay and NYC. Again, this could be because investors price companies in NY and SF meaningfully higher to start with — but it’s heartening nonetheless.

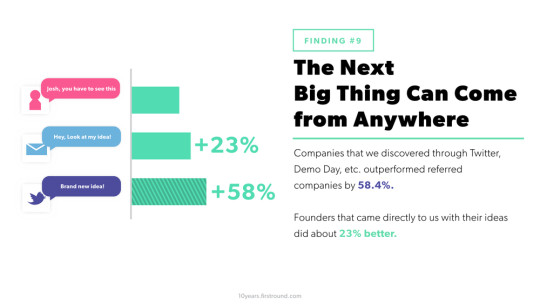

9. The Next Big Thing Can Come from Anywhere

Finally, and perhaps most importantly since it informs where we go looking for deals in the first place, we considered the source of our hundreds of investments over the last decade. We were fascinated to find that incredible investments can literally come from everywhere. For a long time, VC has been predicated on this idea that the best opportunities come through referrals, yet companies that we discovered through other channels — Twitter, Demo Day, etc. — outperformed referred companies by 58.4%. And founders that came directly to us with their ideas did about 23 percent better.

10. The Action is Moving from Sand Hill to San Francisco

As the Bay Area’s startup center of gravity shifts from the South Bay to San Francisco, VCs are moving in droves to the South of Market neighborhood. While we invest across the country, nearly half of founding teams started their companies in the Bay Area. For the first five years of First Round, 2005 to 2009, we invested nearly equally between San Francisco and the rest of the Bay Area. During the last five, the pendulum has swung decisively toward San Francisco with 75 percent of our Bay Area investees starting their companies in the city over that period.

It’s amazing what a decade’s worth of data can show. While these findings won’t dictate how we choose to invest from now on, we’re intrigued by what they say about the shifting direction of our industry. In far fewer than 10 years, venture capital and tech will probably look entirely different than they do today. That’s why we wanted to share — to provide a glimpse into the future — and how we all might play a role in creating an ecosystem that is increasingly vibrant, inclusive, and equal opportunity.

What does data-driven action mean to us? It means innovating and experimenting as fast as a startup to constantly provide a higher caliber of service. It means bringing diverse, remarkable people into the First Round community. And, as leaders in seed stage investing, it means acting on the proof that amazing ideas can come from anywhere by giving all entrepreneurs new ways to be heard. We’ll let you know how it goes.

A little on our methodology

The performance multiples reflect the appreciation (or depreciation) between our original investment and (1) the value at exit (for companies who have exited) or (2) the fair market value we used in our audited December 31, 2014 financial statements.

While we’ve invested in over 300 companies to date, we did not include investments in (1) the 16 companies that we made in the last six months (since their share value wasn’t included in our 2014 financials), (2) the 17 companies that we invested in 2014 that did not raise follow on financing by the end of 2014 (since their share value would not have time to change either up or down) and (3) did not include our investment in Uber (as it would skew all the results – showing that companies with a name that starts with a vowel, for example, perform 100x better than all other investments).

To be clear, we’re not expecting this analysis to get us an invitation to join the ASA. And we are not claiming that our data is representative of the industry…or even statistically significant. Rather, we believe that the data can provide some interesting directional insight. We found some of the learnings to be surprising — and I’m sure we’ll continue to be surprised many more times over the next ten years.

About First Round Capital: First Round is a seed-stage venture firm focused on building a vibrant community of technology entrepreneurs and companies, including Uber, Square and Warby Parker. Through custom-built software, incredible in-person experiences, and a host of other unique services, we help tiny companies get big while constantly reimagining the role of venture capital. Follow on Twitter at @firstround.