A conversation with CNote co-founder and COO Yuliya Tarasava

It’s no small feat to put together a savings vehicle that gives you high returns. How’d you piece it together? Where were the opportunities others had missed?

The last year has been a real adventure. What’s unusual about CNote is rather than creating a new, sexy thing in fintech, we looked at the old world of finance and found what was really working.

We’ve leveraged Community Development Financial Institutions (CDFIs) in a friendly and accessible way. These investments have been around for decades, generated amazing return and impact, but solely for institutions and big banks. We wanted to grant access to everyone, so that the average saver could benefit as well. After clearing some legal hurdles, and leveraging technology, we were able to do just that.

What’s the connection to social good that CNote provides?

The concept of doing good by doing well is in the DNA of our company. First and foremost, this is an opportunity to support disenfranchised business owners and local communities through a system that — without CNote — is not accessible to unaccredited investors. We believe that return and impact can go hand in hand.

To create this new financial product, we partnered with CDFIs, community lenders certified by the U.S. Treasury, whose mission is to provide funding to underserved borrowers like women-led businesses. Ultimately, we provide a high-yield alternative—in both financial return and social impact—to a traditional savings account.

Where did you meet your Co-founder?

A good friend introduced us with the line: “You are two women in finance who want to make a world a better place.” We couldn’t pass on that intro, and we have been friends ever since.

You talk about CNote customers “thinking outside the bank.” Can you talk more about this?

We challenge how people think about their cash and savings. For a long time, banks have been the default option to store our dollars. Savings accounts are an upgrade from stuffing dollars in your mattress—but not by much.

For one, holding money in traditional savings means you are actually losing money to inflation. Banks still have a lot of outmoded characteristics that don’t truly serve their customers. There’s no doubt banks generate a great return using your savings for things like high-interest credit cards, but almost none of that return gets passed on to you, the customer. People have accepted this for a long time, and want to change those expectations.

When savers find out about CNote they will see there are better places to park cash.

How did your past background get you prepared for this journey.

I started my career on Wall Street in risk management and product development, creating some cool financial products that unfortunately were not easily accessible to all.

Being born and raised in Belarus, I was always interested in how finance can contribute to economic development and equality. That interest grew into a passion. How can our financial products be an instrument for change?

As a Global Fellow with Acumen Fund, I joined in a social venture in the financial sector in Kenya to help them with operations and scale. There I saw the tangible positive impact that properly designed financial products and services can have on people’s lives.

How do you think this will change the funding landscape for women-led startups?

CNote’s story is unique in that we are targeting impact on both sides of the equation: savers who can earn more on their dollars and underserved communities looking for funding. Only $1 out of every $27 is lent to women-led businesses. There is a clear bias, not just in the VC world, but in the traditional lending world, that shows the odds are against women.

At CNote, we truly believe we can start correcting the inequity by funneling more dollars to our community lending partners whose mission is to broaden the access to capital. Ultimately, this means more funding for women-owned businesses. We believe in the domino and pay-it-forward effect – each success story of a women-led business contributes to easier access to funding, and serves as a source of inspiration for other women who come after.

About CNote

CNote recently received first-in-kind qualification from the Securities and Exchange Commission (SEC) to make their financial product available to both accredited and unaccredited investors.

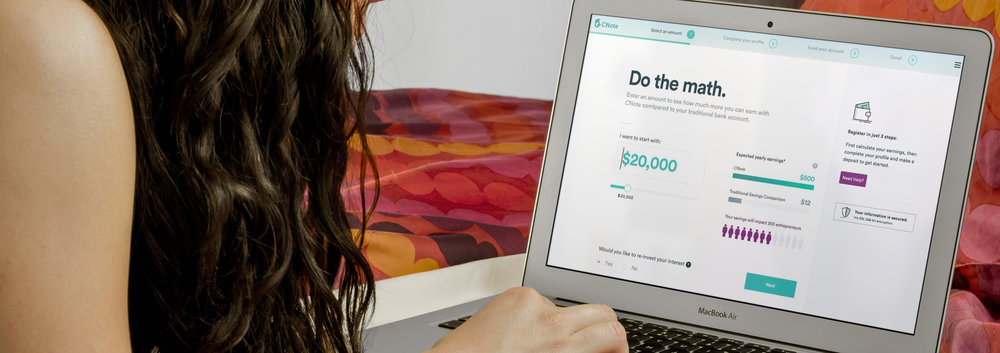

With a focus on delivering competitive returns with social impact, CNote offers up to 40X the return of traditional savings accounts. This is the first-such impact investment product that competes on return with traditional financial instruments and is open to everyone.

CNote pays 2.5% on your savings and delivers 100% social impact to communities across the country. Check them out here.